In today’s competitive business landscape, understanding the return on investment (ROI) of various marketing strategies and customer engagement initiatives is crucial for driving growth and maximizing revenue.

By leveraging Customer Relationship Management (CRM) data, businesses can gain valuable insights into customer behavior, preferences, and interactions. This data can be used to measure the effectiveness of different campaigns and strategies, allowing companies to make informed decisions and optimize their investments.

By analyzing CRM data, organizations can accurately measure ROI and identify areas for improvement, ultimately leading to more targeted and successful marketing efforts.

Unlocking the Power of CRM Data to Measure ROI

Measuring the Return on Investment (ROI) of various business initiatives is crucial for companies to evaluate their effectiveness and make informed decisions.

With the help of Customer Relationship Management (CRM) data, businesses can gain valuable insights into their customers’ behavior, preferences, and interactions. By leveraging CRM data, companies can measure the ROI of their marketing campaigns, sales strategies, and customer engagement initiatives.

Understanding CRM Data and its Role in ROI Measurement

CRM data provides a comprehensive view of customer interactions, including sales, marketing, and customer service activities. By analyzing this data, businesses can identify trends, patterns, and correlations that can help them measure the effectiveness of their initiatives.

For instance, CRM data can help companies track the number of leads generated, conversion rates, and sales revenue, enabling them to calculate the ROI of their marketing campaigns.

Key Metrics for Measuring ROI with CRM Data

To measure ROI effectively, businesses need to track key metrics that are relevant to their goals and objectives.

Some of the key metrics that can be measured using CRM data include Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), and Conversion Rates. By tracking these metrics, businesses can evaluate the effectiveness of their initiatives and make data-driven decisions.

| Metric | Description | Formula |

|---|---|---|

| Customer Acquisition Cost (CAC) | The cost of acquiring a new customer | Total Sales and Marketing Expenses / Number of New Customers |

| Customer Lifetime Value (CLV) | The total value of a customer over their lifetime | Average Order Value x Purchase Frequency x Customer Lifespan |

| Conversion Rate | The percentage of leads that convert into customers | Number of Conversions / Total Number of Leads |

Best Practices for Measuring ROI with CRM Data

To get the most out of CRM data, businesses need to follow best practices that ensure data accuracy, integrity, and analysis. Some of the best practices include Regular Data Cleaning and Maintenance, Standardizing Data Formats, and Using Data Visualization Tools.

By following these best practices, businesses can ensure that their CRM data is reliable, accurate, and actionable, enabling them to make informed decisions that drive business growth.

How do you measure ROI on CRM?

Measuring ROI on CRM involves evaluating the financial returns generated by the implementation of a Customer Relationship Management system. To do this, businesses need to track and analyze various metrics that reflect the impact of CRM on their operations and revenue.

Identifying Key Performance Indicators (KPIs)

To measure ROI on CRM, it’s crucial to identify the right KPIs that align with the business objectives. These KPIs may include metrics such as customer acquisition cost, customer retention rate, sales revenue, and marketing campaign effectiveness.

By tracking these KPIs, businesses can assess the effectiveness of their CRM system in driving revenue and improving customer relationships.

- Customer acquisition cost: the cost of acquiring a new customer, including sales and marketing expenses

- Customer retention rate: the percentage of customers retained over a specific period

- Sales revenue: the revenue generated from sales, including new and existing customers

Calculating CRM ROI

To calculate CRM ROI, businesses need to compare the benefits generated by the CRM system to its costs. This involves quantifying the financial returns, such as increased revenue and cost savings, and comparing them to the total cost of ownership, including implementation, maintenance, and support costs.

By doing so, businesses can determine whether their CRM investment is yielding a positive return.

- Quantify the financial benefits: increased revenue, cost savings, and improved productivity

- Calculate the total cost of ownership: implementation, maintenance, support, and training costs

- Compare benefits to costs: determine the ROI by comparing the financial benefits to the total cost of ownership

Analyzing CRM Data

Analyzing CRM data is essential to measuring ROI, as it provides insights into customer behavior, sales trends, and marketing effectiveness.

By analyzing CRM data, businesses can identify areas of improvement, optimize their sales and marketing strategies, and make data-driven decisions to drive revenue growth. Effective data analysis involves using various tools and techniques to extract insights from CRM data.

- Data visualization: using charts, graphs, and dashboards to visualize CRM data

- Data mining: using statistical techniques to identify patterns and trends in CRM data

- Reporting: generating regular reports to track KPIs and measure CRM effectiveness

Why is estimating the ROI of an CRM project difficult?

Estimating the ROI of a CRM project is difficult due to various factors that make it challenging to quantify the benefits and costs associated with the implementation. One of the primary reasons is that CRM projects often involve a wide range of intangible benefits, such as improved customer satisfaction, enhanced customer experience, and increased employee productivity, which are hard to measure.

Complexity of CRM Implementation

The complexity of CRM implementation is a significant factor that makes it difficult to estimate ROI. CRM projects often involve multiple stakeholders, various technology components, and changes to business processes, making it challenging to identify and quantify all the costs and benefits.

- Multiple stakeholders are involved in the project, including IT, sales, marketing, and customer service teams.

- The implementation involves various technology components, such as software, hardware, and infrastructure.

- Changes to business processes are often required to fully leverage the CRM system.

Intangible Benefits and Metrics

CRM projects often result in intangible benefits that are difficult to quantify. For example, improved customer satisfaction and loyalty are crucial outcomes of a successful CRM implementation, but measuring these benefits can be challenging.

- Customer satisfaction is often measured through surveys, which can be subjective and may not accurately reflect the true level of satisfaction.

- Loyalty programs can be used to measure customer retention, but the impact of CRM on loyalty is often indirect and difficult to isolate.

- Other intangible benefits, such as improved brand reputation and enhanced customer experience, are also challenging to quantify.

Variability in ROI Calculation Methods

The method used to calculate ROI can also impact the accuracy of the estimate. Different organizations may use different methods to calculate ROI, which can lead to varying results.

- The payback period method calculates the time it takes for the investment to generate returns.

- The net present value (NPV) method calculates the present value of future cash flows.

- The internal rate of return (IRR) method calculates the rate of return based on the initial investment and expected cash flows.

What is the difference between CRM and ROI?

The difference between CRM and ROI lies in their definitions and purposes. CRM stands for Customer Relationship Management, which refers to the strategies, technologies, and practices used by companies to manage and analyze customer interactions throughout the customer lifecycle.

On the other hand, ROI stands for Return on Investment, which is a financial metric used to evaluate the performance of an investment by calculating the return or profit that it generates in relation to its cost.

Understanding CRM

Customer Relationship Management is a crucial aspect of business operations as it enables companies to build strong relationships with their customers, enhance customer satisfaction, and ultimately drive sales growth. Effective CRM involves collecting and analyzing customer data to gain insights into their behavior, preferences, and needs.

- CRM systems help businesses to streamline processes and improve customer engagement.

- They enable companies to personalize their marketing efforts and improve customer retention.

- CRM also facilitates the analysis of customer data to identify new sales opportunities.

Calculating ROI

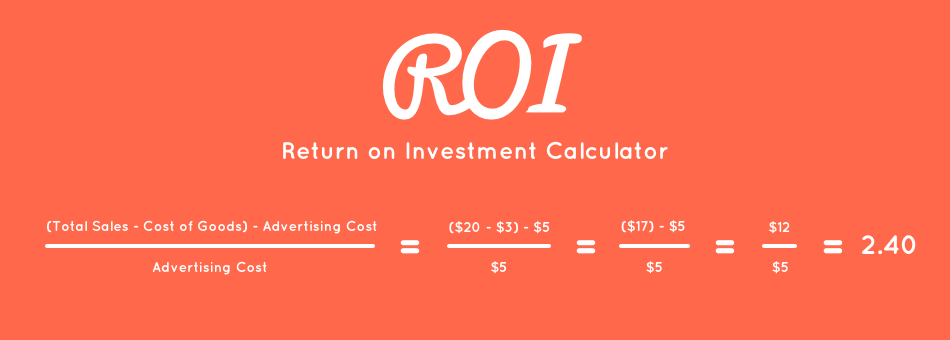

Return on Investment is a key performance indicator that helps businesses to assess the financial effectiveness of their investments. ROI is calculated by comparing the net gain of an investment to its cost, and it is usually expressed as a percentage. A higher ROI indicates a more profitable investment.

- To calculate ROI, businesses need to determine the net gain from an investment.

- The cost of the investment, including any associated expenses, must also be considered.

- ROI can be used to compare the financial performance of different investments.

Linking CRM and ROI

While CRM and ROI are distinct concepts, they are interconnected in the sense that effective CRM can lead to improved ROI. By implementing a robust CRM strategy, businesses can enhance customer satisfaction, increase sales, and ultimately drive revenue growth, all of which can contribute to a higher ROI.

- A well-implemented CRM system can help businesses to reduce customer acquisition costs.

- By improving customer retention, CRM can lead to increased revenue and profitability.

- CRM can also enable businesses to identify new sales opportunities, further enhancing ROI.

What is the best way to measure ROI?

Measuring Return on Investment (ROI) is a crucial aspect of evaluating the effectiveness of various business initiatives, investments, or marketing campaigns. The best way to measure ROI involves a comprehensive approach that considers multiple factors and metrics.

Understanding the ROI Formula

The traditional ROI formula is calculated by dividing the net gain (return) by the cost of investment, and then multiplying by 100 to express it as a percentage. To apply this formula effectively, it’s essential to accurately identify and quantify both the returns and the costs associated with the investment.

- Identify the returns generated by the investment, such as increased revenue or cost savings.

- Determine the total cost of the investment, including initial outlays and ongoing expenses.

- Apply the ROI formula: (Net Gain / Cost of Investment) 100.

Key Metrics for ROI Measurement

Beyond the basic ROI formula, several key metrics can provide a more nuanced understanding of an investment’s performance. These metrics can help in assessing the efficiency and profitability of investments.

- Payback Period: The time it takes for the investment to generate returns equal to its initial cost.

- Net Present Value (NPV): The present value of future cash flows from the investment, discounted to reflect the time value of money.

- Internal Rate of Return (IRR): The rate of return at which the NPV of the investment equals zero, helping to compare different investment opportunities.

Advanced ROI Considerations

For a more sophisticated ROI analysis, consider incorporating intangible benefits, opportunity costs, and risk assessments. This can involve more complex calculations and the use of advanced analytical tools.

- Quantify intangible benefits, such as brand enhancement or customer satisfaction improvements.

- Assess opportunity costs, or the potential returns from alternative investments.

- Factor in risk assessments to account for the uncertainty of future returns.

Frequently Asked Questions

What is ROI and why is it important in CRM?

Return on Investment (ROI) is a metric used to evaluate the financial return of an investment. In CRM, ROI measures the effectiveness of customer relationship management strategies. It’s essential to understand ROI to optimize marketing campaigns, improve customer engagement, and increase revenue. By measuring ROI, businesses can make data-driven decisions to enhance their CRM initiatives.

How can CRM data be used to measure ROI?

CRM data provides valuable insights into customer behavior, preferences, and interactions. By analyzing this data, businesses can track the success of marketing campaigns, sales efforts, and customer retention strategies. CRM data can be used to measure ROI by monitoring metrics such as conversion rates, customer acquisition costs, and revenue generated from specific campaigns or initiatives.

What are the key metrics to measure ROI with CRM data?

Key metrics to measure ROI with CRM data include customer acquisition cost, customer lifetime value, conversion rates, sales revenue, and marketing campaign ROI. Additionally, metrics such as customer retention rates, lead generation, and sales pipeline growth can also be used to evaluate the effectiveness of CRM initiatives. By tracking these metrics, businesses can gain a comprehensive understanding of their ROI.

How often should ROI be measured using CRM data?

ROI should be measured regularly to ensure that CRM initiatives are on track and to identify areas for improvement. The frequency of measurement depends on the specific business and industry, but it’s common to measure ROI quarterly or annually. Regular measurement enables businesses to adjust their strategies, optimize resources, and maximize their ROI.